UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant ¨ | |

| Check the appropriate box: | |

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

| ADAPTIMMUNE THERAPEUTICS PLC |

| (Name of Registrant as Specified In Its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | |

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Adaptimmune Therapeutics PLC

Registered office: 60 Jubilee Avenue, Milton Park

Abingdon, Oxfordshire OX14 4RX, U.K.

Incorporated in England & Wales with registered no. 09338148

April [ ], 2022

Dear Shareholder:

2022 Annual General Meeting of Adaptimmune Therapeutics plc (the “AGM”)

This letter, the notice of the AGM set out in this document (“the Notice”) and associated materials for the AGM are being sent or supplied to you because, as of April 19, 2022 (being the latest practicable date before the circulation of this document), you are registered as a holder of ordinary shares in the register of members of the Company. However, this letter, the Notice and associated materials will also be available to holders of American Depositary Shares (“ADS”) and contain information relevant to holders of ADSs.

I am pleased to confirm that our AGM will take place at 11:00 a.m. London time (6:00 a.m. Eastern Standard Time) on Wednesday, May 25, 2022 at 60 Jubilee Avenue, Milton Park, Abingdon, Oxfordshire OX14 4RX. The Notice is set out in this document and it contains the resolutions to be proposed at the AGM (the “Resolutions”).

Action to be taken by holders of ordinary shares in the Company

If you are a holder of American Depositary Shares (“ADSs”), please ignore this section and refer instead to the section below — “Holders of American Depositary Shares”.

If you are a holder of ordinary shares in the Company and are planning to attend the AGM in person (or by way of corporate representative) it would be helpful if you could inform Margaret Henry, Company Secretary, by email: margaret.henry@adaptimmune.com, or mobile: +44 (0)7710 304249.

If you are unable to attend the AGM, you can still vote on the Resolutions by appointing a proxy. A form of proxy for use at the AGM is enclosed, or is being sent to you by email if you have opted to receive information by email. You are able to submit your proxy vote online at www.investorcentre.co.uk/eproxy (see instructions on form of proxy) to arrive by no later than 11:00 a.m. London time (6:00 a.m. Eastern Standard Time) on Monday, May 23, 2022.

Alternatively, if you have received a printed form of proxy and prefer to return it by post, you are advised to complete and return the form of proxy in accordance with the instructions printed on it and so as to arrive at the Company’s registrar, Computershare Investor Services PLC, The Pavilions, Bridgwater Road, Bristol, BS99 6ZY, England as soon as possible but in any event by no later than 11:00 a.m. London time (6:00 a.m. Eastern Standard Time) on Monday, May 23, 2022. CREST members may appoint a proxy by using the CREST electronic proxy appointment service. The return of a form of proxy or the electronic appointment of a proxy does not preclude you from attending and voting at the AGM if you so wish.

In order to attend and vote at the AGM as an ordinary shareholder or for your form of proxy to remain valid, you must continue to be registered as a holder of ordinary shares in the Company’s register of members as of 6:30 p.m. London time (1:30 p.m. Eastern Standard Time) on Monday, May 23, 2022.

Therefore, if you sell or transfer your ordinary shares in the Company on or prior to May 23, 2022, your form of proxy can no longer be used and if submitted (whether before or after you sell or transfer your ordinary shares) will be treated as invalid. Please pass this document to the person who arranged the sale or transfer for delivery to the purchaser or transferee. The purchaser or transferee should contact Margaret Henry, Company Secretary, to request a new form of proxy for its use.

Should you elect to convert your holding of ordinary shares in the capital of the Company into an interest in the capital of the Company represented by ADSs before the AGM, you will cease to be a holder of ordinary shares in your own name and will not be entitled to vote at the AGM as an ordinary shareholder. You will also not be able to use the form of proxy that has been sent to you. However, you may be able to exercise your vote as a holder of an interest in the capital of the Company represented by American Depositary Shares — please refer to the next section — “Holders of American Depositary Shares”.

Holders of American Depositary Shares

In order to exercise your vote as a holder of an interest in the capital of the Company represented by ADSs, you or your bank, broker or nominee must be registered as a holder of ADSs in the ADS register by 5:00 p.m. Eastern Standard Time on Thursday, April 21, 2022 (the record date for ADS holders).

If you hold ADSs through a bank, broker or nominee on April 21, 2022, the AGM documentation, including the ADS proxy card, will be sent to your broker who should forward the materials to you. Please reach out to your broker to provide your voting instructions.

Please note that ADS proxy cards submitted by ADS holders must be received by Citibank, N.A. no later than 10:00 a.m. Eastern Standard Time on Thursday, May 19, 2022.

Contact for ADS holders

If you have queries about how you can deliver voting instructions, please contact Citibank, N.A. — ADR Shareholder Services at tel: +1-877-248-4237 (toll free within the United States) or +1-781-575-4555 (for international callers) or by email: citibank@shareholders-online.com or at Citibank Shareholder Services, P.O. Box 43077, Providence, RI 02940-3077.

Contact at Adaptimmune

If at any point you require guidance, please contact Margaret Henry, Company Secretary, on email: margaret.henry@adaptimmune.com or cell: +44 (0)7710 304249.

Recommendation

You will find an explanatory note in relation to each of the Resolutions in the attached proxy statement. Your Directors consider that each Resolution is in the best interests of the Company and its shareholders as a whole and is likely to promote the success of the Company. Accordingly, your Directors unanimously recommend that you vote in favor of the Resolutions as each of the Directors with personal holdings of shares in the Company intends to do in respect of their own beneficial holdings of shares.

Thank you for your ongoing support of Adaptimmune.

Yours sincerely,

| /s/ David M. Mott | |

| David M. Mott | |

| Chairman, Adaptimmune Therapeutics plc |

Adaptimmune Therapeutics PLC

60 Jubilee Avenue, Milton Park

Abingdon, Oxfordshire OX14 4RX, U.K.

Registered Company No. 09338148

NOTICE OF 2022 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, MAY 25, 2022

NOTICE is hereby given that the Annual General Meeting of Adaptimmune Therapeutics plc, a public limited company incorporated under the laws of England and Wales (referred to herein as the “Company,” “we,” “us” and “our”), will be held on Wednesday, May 25, 2022, at 11:00 a.m. London time (6:00 a.m. Eastern Standard time), at 60 Jubilee Avenue, Milton Park, Abingdon, Oxfordshire OX14 4RX, for transaction of the following business:

Ordinary resolutions

1. To re-elect as a director, Ali Behbahani, who retires by rotation in accordance with the Articles of Association.

2. To re-elect as a director, John Furey, who retires by rotation in accordance with the Articles of Association.

3. To re-elect as a director, James Noble, who retires by rotation in accordance with the Articles of Association.

4. To re-appoint KPMG LLP as auditors of the Company, to hold office until the conclusion of the next annual general meeting of shareholders.

5. To authorize the Audit Committee to determine our auditors’ remuneration for the fiscal year ending December 31, 2022.

6. To adopt the U.K. statutory annual accounts and reports for the fiscal year ended December 31, 2021 and to note that the Directors do not recommend the payment of any dividend for the year ended December 31, 2021.

7. To approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers for the year ended December 31, 2021, as disclosed in the Company’s proxy statement under the “Executive Compensation Discussion and Analysis” section, the compensation tables and the narrative disclosures that accompany the compensation tables.

8. To approve our U.K. statutory directors’ remuneration report for the year ended December 31, 2021 (excluding our directors’ remuneration policy), which is set forth as Annex A to the Company’s proxy statement.

9. To authorize the directors generally and unconditionally for the purpose of s551 of the U.K. Companies Act 2006 to allot shares in the Company or to grant rights to subscribe for or to convert any security into shares in the Company (“Rights”) up to a maximum aggregate nominal amount of £310,638.00 to such persons at such times and upon such conditions as the directors may determine (subject to the Company’s articles of association). This authority shall expire (unless previously renewed, varied or revoked) on the earlier of the conclusion of the annual general meeting in 2023 and June 30, 2023 but so that the Company may make offers and enter into agreements before that expiry which would, or might, require shares to be allotted or Rights to be granted after that expiry and the directors may allot shares or grant Rights pursuant to any of those offers or agreements as if the authority had not expired.

The authority referred to in this resolution is in substitution for the authority conferred on the directors under s551 of the U.K. Companies Act 2006 at the annual general meeting held on May 14, 2021 but the directors may allot shares or grant Rights pursuant to an offer made or agreement entered into by the Company before the expiry of the authority pursuant to which that offer was made or agreement entered into.

Special resolution

10. Subject to the passing of Resolution 9, to empower the directors generally pursuant to s570(1) of the U.K. Companies Act 2006 to allot equity securities (as defined in s560 of the U.K. Companies Act 2006) for cash pursuant to the general authority conferred on them by Resolution 9 as if s561(1) of the U.K. Companies Act 2006 did not apply to that allotment. This power:

(a) shall be limited to the allotment of equity securities up to an aggregate nominal amount of £310,638.00;

(b) expires (unless previously renewed, varied or revoked) on the earlier of the conclusion of the annual general meeting in 2023 and June 30, 2023 but so that the Company may make offers and enter into agreements before that expiry which would, or might, require equity securities to be allotted after that expiry and the directors may allot equity securities pursuant to any of those offers or agreements as if this power had not expired; and

(c) applies in relation to a sale of shares which is an allotment of equity securities by virtue of s560(3) of the U.K. Companies Act 2006 as if in the first paragraph of this resolution the words “pursuant to the general authority conferred on them by Resolution 9” were omitted.

For the purposes of this resolution, references to the allotment of equity securities shall be interpreted in accordance with s560 of the U.K. Companies Act 2006.

Proposals 1 through 9 will be proposed as ordinary resolutions and under English law, assuming that a quorum is present, an ordinary resolution is passed on a show of hands if it is approved by a simple majority (more than 50%) of the votes cast by shareholders present (in person or by proxy) at the meeting and entitled to vote. If a poll is demanded, an ordinary resolution is passed if it is approved by holders representing a simple majority of the total voting rights of shareholders present (in person or by proxy) who (being entitled to vote) vote on the resolution. Proposal 10 will be proposed as a special resolution. Special resolutions require the affirmative vote of not less than 75% of the votes cast by shareholders present (in person or by proxy) at the meeting and entitled to vote. On a poll, a special resolution is passed if it is approved by holders representing not less than 75% of the total voting rights of shareholders present (in person or by proxy) who (being entitled to vote) vote on the resolution.

The result of the shareholder votes on the ordinary resolutions in proposals 6, 7 and 8 regarding adoption of our U.K. statutory annual accounts and reports for the year ended December 31, 2021, approval of the compensation of our named executive officers for the year ended December 31, 2021 and approval of our U.K. statutory directors’ annual report on remuneration for the year ended December 31, 2021 (excluding the directors’ remuneration policy) will not require our Board of Directors or any committee thereof to take any action. Our Board of Directors values the opinions of our shareholders as expressed through such votes and will carefully consider the outcome of the votes on proposals 6, 7 and 8.

The results of any polls taken on the resolutions at the Annual General Meeting and any other information required by the U.K. Companies Act 2006 will be made available on our website (https://www.adaptimmune.com) as soon as reasonably practicable following the Annual General Meeting and for the required period thereafter.

| BY ORDER OF THE BOARD | Registered Office | |

| 60 Jubilee Avenue, Milton Park, | ||

| /s/ Margaret Henry | Abingdon, | |

| Margaret Henry | Oxfordshire OX14 4RX, United Kingdom | |

| Company Secretary | Registered in England and Wales | |

| April [ ], 2022 | No 09338148 |

Notes

| (a) | Only those members registered in the register of members of the Company at 6:30 p.m. London time (1:30 p.m. Eastern Standard Time) on May 23, 2022 will be entitled to attend and vote at the Annual General Meeting (“AGM”) in respect of the number of ordinary shares registered in their name at the time. Changes to entries on the relevant register after that deadline will be disregarded in determining the rights of any person to attend and vote at the AGM. Should the AGM be adjourned to a time not more than 48 hours after the deadline, the same deadline will also apply for the purpose of determining the entitlement of members to attend and vote (and for the purpose of determining the number of votes they may cast) at the adjourned AGM. Should the AGM be adjourned for a longer period, then to be so entitled, members must be entered on the Register at the time which is 48 hours before the time fixed for the adjourned AGM or, if the Company gives notice of the adjourned AGM, at the time specified in the notice. |

| (b) | Any member may appoint a proxy to attend, speak and vote on his/her behalf. A member may appoint more than one proxy in relation to the AGM provided that each proxy is appointed to exercise the rights attached to a different share or shares of the member. A proxy need not be a member, but must attend the meeting in person. Proxy forms should be lodged with the Company’s Registrar (Computershare) not later than 11:00 a.m. London time (6:00 a.m. Eastern Standard Time) on May 23, 2022. Completion and return of the appropriate proxy form does not prevent a member from attending and voting in person if he/she is entitled to do so and so wishes. The attached proxy statement explains proxy voting and the matters to be voted on in more detail. Please read the proxy statement carefully. For specific information regarding the voting of your ordinary shares, please refer to the proxy statement under the section entitled “Questions and Answers About Voting.” |

| (c) | Any corporation which is a member can appoint one or more corporate representatives who may exercise on its behalf all of its powers as a member provided that they do not do so in relation to the same shares. |

| (d) | In the case of joint holders, the vote of the senior who tenders the vote whether in person or by proxy will be accepted to the exclusion of the votes of any other joint holders. For these purposes, seniority shall be determined by the order in which the names stand in the Company’s relevant register or members for the certificated or uncertificated shares of the Company (as the case may be) in respect of the joint holding. |

| (e) | CREST members who wish to appoint a proxy or proxies through the CREST electronic proxy appointment service may do so for the AGM and any adjournments of it by using the procedures described in the CREST Manual. CREST personal members or other CREST sponsored members, and those CREST members who have appointed voting service providers, should refer to their sponsors or voting service providers, who will be able to take the appropriate action on their behalf. |

For a proxy appointment or instruction made using the CREST service to be valid, the appropriate CREST message (a “CREST Proxy Instruction”) must be properly authenticated in accordance with Euroclear’s specifications and must contain the information required for those instructions as described in the CREST Manual (available via www.euroclear.com). The message, regardless of whether it relates to the appointment of a proxy or to an amendment to the instruction given to the previously appointed proxy, must, to be valid, be transmitted so as to be received by the Company’s agent 3RA50 by 11:00 a.m. London time (6:00 a.m. Eastern Standard Time) on May 23, 2022. For this purpose, the time of receipt will be taken to be the time (as determined by the timestamp applied to the message by the CREST Applications Host) from which the Company’s agent is able to retrieve the message by enquiry to CREST in the manner prescribed by CREST. After this time, any change of instructions to proxies appointed through CREST should be communicated to the appointee through other means.

CREST members and, where applicable, their CREST sponsors or voting service providers should note that Euroclear UK does not make available special procedures in CREST for any particular messages. Normal system timings and limitations will, therefore, apply in relation to the input of CREST Proxy Instructions. It is the responsibility of the CREST member concerned to take (or, if the CREST member is a CREST personal member or sponsored member or has appointed voting service providers, to procure that its CREST sponsors or voting service providers take) such action as shall be necessary to ensure that a message is transmitted by means of the CREST system by any particular time. In this connection, CREST members and, where applicable, their CREST sponsors or voting service providers are referred, in particular, to those sections of the CREST Manual concerning practical limitations of the CREST system and timings.

The Company may treat as invalid a CREST Proxy Instruction in the circumstances set out in Regulation 35(5)(a) of the Uncertificated Securities Regulations 2001.

| (f) | As of April 19, 2022 (being the last practicable date before circulation of this Notice), the Company’s issued ordinary share capital consisted of [ ] ordinary shares, carrying one vote each. Therefore, the total voting rights in the Company as of that date are [ ]. |

| (g) | Under s527 Companies Act 2006, members meeting the threshold requirement set out in that section have the right to require the Company to publish on a website a statement setting out any matter relating to: (i) the audit of the Company’s accounts (including the auditor’s report and the conduct of the audit) that are to be laid before the AGM; or (ii) any circumstance connected with an auditor of the Company ceasing to hold office since the previous meeting at which annual accounts and reports were laid in accordance with s437 Companies Act 2006. The Company may not require the shareholders requesting any such website publication to pay its expenses in complying with ss527 or 528 Companies Act 2006. Where the Company is required to place a statement on a website under s527 Companies Act 2006, it must forward the statement to the Company’s auditor not later than the time when it makes the statement available on the website. The business which may be dealt with at the AGM includes any statement that the Company has been required, under s527 Companies Act 2006, to publish on a website. |

| (h) | Except as set out in the notes to this Notice, any communication with the Company in relation to the AGM, including in relation to proxies, should be sent to the Company’s Registrar, Computershare Investor Services PLC, The Pavilions, Bridgwater Road, Bristol, BS99 6ZY, England. No other means of communication will be accepted. In particular, you may not use any electronic address provided either in this notice or in any related documents to communicate with the Company for any purpose other than those expressly stated. |

| (i) | Copies of the employment agreement for our executive director and of the letters of appointment for our non-executive directors will be available for inspection at the registered office of the Company during normal business hours on any week day (public holidays excepted) from the date of this Notice of AGM until the date of the AGM, and at the place of the AGM for one hour before the meeting and at the meeting itself. |

TABLE OF CONTENTS

Adaptimmune Therapeutics PLC

60 Jubilee Avenue, Milton Park

Abingdon, Oxfordshire OX14 4RX, U.K.

Registered Company No. 09338148

PROXY STATEMENT FOR THE 2022 ANNUAL GENERAL MEETING OF

SHAREHOLDERS TO BE HELD ON MAY 25, 2022

INFORMATION CONCERNING PROXY SOLICITATION AND VOTING

We have sent you this proxy statement and the enclosed form of proxy because the Board of Directors of Adaptimmune Therapeutics plc (referred to herein as the “Company”, “we”, “us” or “our”) is soliciting your proxy to vote at our annual general meeting of shareholders (referred to herein as the “Meeting” or the “AGM”) to be held on Wednesday, May 25, 2022, at 11:00 a.m. London time (6:00 a.m. Eastern Standard time), at 60 Jubilee Avenue, Milton Park, Abingdon, Oxfordshire OX14 4RX.

| • | This proxy statement summarizes information about the proposals to be considered at the Meeting and other information you may find useful in determining how to vote. |

| • | The form of proxy is the means by which you actually authorize another person to vote your shares in accordance with your instructions. |

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail, internet and personal solicitation. All costs of solicitation of proxies will be covered by us.

We are sending or supplying the Notice of 2022 AGM, this proxy statement and the form of proxy to our ordinary shareholders of record as of April 19, 2022 (being the latest practicable date before the circulation of this document) for the first time on or about April [ ], 2022. We are also including our U.K. statutory annual accounts and reports for the year ended December 31, 2021 (“2021 U.K. Annual Report”) and our annual report on Form 10-K for the year ended December 31, 2021 (the “Annual Report on Form 10-K”). In addition, we are sending or supplying our proxy materials, including this proxy statement and the Annual Report on Form 10-K to brokers, dealers, bankers and their nominees, so that they can supply these materials to the beneficial owners of our ordinary shares.

Whilst this document is being sent or supplied to our ordinary shareholders of record, this document will also be made available to holders of American Depositary Shares (“ADSs”) and contains information relevant to holders of ADSs.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on May 25, 2022

Our Notice of 2022 AGM, this proxy statement, the Annual Report on Form 10-K, our 2021 U.K. Annual Report and our form of proxy are available in the Investors section of our website at https://www.adaptimmune.com.

QUESTIONS AND ANSWERS ABOUT VOTING

Why am I receiving these materials?

We have sent you this proxy statement and the enclosed form of proxy because you are an ordinary shareholder of record and our Board of Directors (the “Board”) is soliciting your proxy to vote at the Meeting, including at any adjournments or postponements of the Meeting. You are invited to attend the Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the Meeting to vote your shares. Instead, please submit your proxy online at www.investorcentre.co.uk/eproxy (see instructions on form of proxy). Alternatively, you may simply complete, sign and return the enclosed form of proxy. CREST members may appoint a proxy by using the CREST electronic proxy appointment service. All proxies, however submitted, must be lodged with our registrar, Computershare, by no later than 11:00 a.m. London time (6:00 a.m. Eastern Standard Time) on Monday, May 23, 2022.

1

We intend to send this proxy statement and the accompanying form of proxy on or about April [ ], 2022 to all ordinary shareholders of record as of April 19, 2022.

Materials for ADS holders of record, including the Depositary’s notice of meeting, incorporating a link to the proxy materials on the Adaptimmune website, and an ADS proxy card, will be mailed on or about April [ ], 2022 to all ADS holders, including banks, brokers and nominees, who are registered as holders of ADSs in the ADS register by 5:00 p.m. Eastern Standard Time on April 21, 2022 (the record date for ADS holders).

Who can vote at the Meeting?

Ordinary shareholders

Only ordinary shareholders of record registered in the register of members at 6:30 p.m. London time (1:30 p.m. Eastern Standard Time) on Monday, May 23, 2022 will be entitled to vote at the Meeting. As of April 19, 2022 (being the last practicable date before the circulation of this proxy statement) there were [ ] ordinary shares issued and outstanding and entitled to vote.

Whether or not you plan to attend the Meeting, we urge you to submit your proxy to ensure you count towards the quorum and your vote is counted. Please submit your proxy online at www.investorcentre.co.uk/eproxy (see instructions on form of proxy). Alternatively, please complete and return the enclosed form of proxy. CREST members may appoint a proxy by using the CREST electronic proxy appointment service.

All proxies, however submitted, must be lodged with our registrar, Computershare, by no later than 11:00 a.m. London time (6:00 a.m. Eastern Standard Time) on Monday, May 23, 2022.

If you sell or transfer your ordinary shares in the Company on or prior to May 23, 2022, your form of proxy can no longer be used and if submitted (whether before or after you sell or transfer your ordinary shares) will be treated as invalid. Please pass this document to the person who arranged the sale or transfer for delivery to the purchaser or transferee. The purchaser or transferee should contact Margaret Henry, Company Secretary, to request a new form of proxy for its use.

Beneficial owners of ordinary shares which are registered in the name of a broker, bank or other agent

If, on April 19, 2022, your ordinary shares were held in an account at a brokerage firm, bank or other similar organization and you are the beneficial owner of shares, these proxy materials should be forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Meeting by proxy. You are encouraged to provide voting instructions to your broker or other agent so that they may submit a proxy.

Holders of American Depositary Shares

You are entitled to exercise your vote as a holder of an interest in the capital of the Company represented by ADSs if you or your brokerage firm, bank or nominee is registered as a holder of ADSs in the ADS register by 5:00 p.m. Eastern Standard Time on Thursday, April 21, 2022 (the record date for ADS holders).

If you hold ADSs through a brokerage firm, bank or nominee on April 21, 2022, the materials for ADS holders, including the Depositary’s notice of meeting, incorporating a link to the materials on the Adaptimmune website, and the ADS proxy card, will be sent to that organization. The organization holding your account is considered the ADS holder of record. Please reach out to that organization to provide your voting instructions.

Please note that ADS proxy cards submitted by ADS holders must be received by Citibank, N.A. by no later than 10:00 a.m. Eastern Standard Time on Thursday, May 19, 2022.

Citibank, N.A. will collate all votes properly submitted by ADS holders and submit a vote on behalf of all ADS holders.

Contact for ADS holders

If you have queries about how you can deliver voting instructions, please contact Citibank, N.A. — ADR Shareholder Services at tel: +1-877-248-4237 (toll free within the United States) or +1-781-575-4555 (for international callers) or by email: citibank@shareholders-online.com or at Citibank Shareholder Services, P.O. Box 43077, Providence, RI 02940-3077.

2

Contact at Adaptimmune

If at any point you require guidance, please contact Margaret Henry, Company Secretary, on email: margaret.henry@adaptimmune.com, tel: +44(0)1235 430036 or cell: +44 (0)7710 304249.

What are the requirements to elect the directors and approve each of the proposals?

You may cast your vote for or against proposals 1 through 10 or abstain from voting your shares on one or more of these proposals.

Proposals 1 through 9 will be proposed as ordinary resolutions. Proposal 10 will be proposed as a special resolution. Under English law, assuming that a quorum is present, an ordinary resolution is passed on a show of hands if it is approved by a simple majority (more than 50%) of the votes cast by shareholders present (in person or by proxy) at the Meeting and entitled to vote. If a poll is demanded, an ordinary resolution is passed if it is approved by holders representing a simple majority of the total voting rights of shareholders present (in person or by proxy) who (being entitled to vote) vote on the resolution. Special resolutions require the affirmative vote of not less than 75% of the votes cast by shareholders present (in person or by proxy) at the Meeting and entitled to vote. On a poll, a special resolution is passed if it is approved by holders representing not less than 75% of the total voting rights of shareholders present (in person or by proxy) who (being entitled to vote) vote on the resolution.

The result of the shareholder votes on the ordinary resolutions in proposals 6, 7 and 8 regarding adoption of our U.K. statutory annual accounts and reports for the year ended December 31, 2021, approval of the compensation of our named executive officers for the year ended December 31, 2021 and approval of our U.K. statutory directors’ annual report on remuneration for the year ended December 31, 2021 (excluding the directors’ remuneration policy) will not require our Board of Directors or any committee thereof to take any action. Nonetheless, our Board of Directors values the opinions of our shareholders as expressed through such votes and will carefully consider the outcome of the votes on proposals 6, 7 and 8.

What are the voting recommendations of our Board regarding the election of directors and other proposals?

The following table summarizes the items that will be brought for a vote of our shareholders at the Meeting, along with the Board’s voting recommendations.

| Proposal | Description of Proposal | Board’s Recommendation | ||||||

| 1 | Re-election of Ali Behbahani as a director | FOR | ||||||

| 2 | Re-election of John Furey as a director | FOR | ||||||

| 3 | Re-election of James Noble as a director | FOR | ||||||

| 4 | Re-appointment of KPMG LLP as the Company’s auditors, to hold office until the conclusion of the next annual general meeting of shareholders | FOR | ||||||

| 5 | Authorization for the Audit Committee to determine our auditors’ remuneration for the fiscal year ending December 31, 2022 | FOR | ||||||

| 6 | To adopt the U.K. statutory annual accounts and reports for the fiscal year ended December 31, 2021 | FOR | ||||||

| 7 | Approval of the compensation of our named executive officers for the year ended December 31, 2021, which is set forth in this proxy statement | FOR | ||||||

| 8 | Approval of our U.K. statutory directors’ annual report on remuneration for the year ended December 31, 2021 (excluding our directors’ remuneration policy), which is set forth as Annex A | FOR | ||||||

| 9 | Authorization for the Board of Directors to allot shares or to grant rights to subscribe for or convert any security into shares up to a maximum aggregate nominal amount of £310,638.00. | FOR | ||||||

| 10 | Empowering the Board of Directors to allot equity securities for cash up to a maximum aggregate nominal amount of £310,638.00 pursuant to the authorization in Proposal No. 9 as if U.K. statutory pre-emption rights did not apply. | FOR |

3

What constitutes a quorum?

For the purposes of the Meeting, a quorate meeting will be formed by two persons being present and between them holding (or being the proxy or corporative representative of the holders of) at least one-third in number of the issued ordinary shares of the Company entitled to vote at the Meeting.

If you are an ordinary shareholder of record, your shares will be counted towards the quorum only if you are present in person or represented by proxy at the Meeting. If you are a beneficial owner of ordinary shares held in an account at a brokerage firm, bank or other similar organization your shares will be counted towards the quorum if your broker or nominee submits a proxy for those shares and the proxy represents the holder at the Meeting. A member represented by a proxy at the Meeting will be counted towards the quorum requirement even where the proxy abstains from voting. If a form of proxy does not instruct the proxy how to vote, the proxy may vote as he or she sees fit or abstain in relation to any business of the Meeting, but the member represented by that proxy at the Meeting will be counted towards the quorum requirement. If there is no quorum, the Meeting will stand adjourned to such time, date and place as may be fixed by the chairperson of the Meeting (being not less than 10 days later), and, if a quorum is not present at the adjourned meeting, the Meeting will be dissolved.

How do I vote my shares?

If you are an ordinary “shareholder of record,” you may appoint a proxy to vote on your behalf:

| • | By submitting your proxy online at www.investorcentre.co.uk/eproxy (see instructions on form of proxy); or |

| • | By completing and signing the form of proxy and returning it in the envelope provided; or |

| • | For CREST members, by appointing a proxy by using the CREST electronic proxy appointment service. |

All proxies (however submitted) must be lodged with our registrar (Computershare) by no later than 11:00 a.m. London time (6:00 a.m. Eastern Standard Time) on Monday, May 23, 2022.

If you properly give instructions as to your proxy appointment by executing and returning a form of proxy, or by submitting your proxy online, and your proxy appointment is not subsequently revoked, your shares will be voted in accordance with your instructions.

If your ordinary shares are held in an account at a brokerage firm, bank or similar organization, you should follow directions provided by your broker, bank or other nominee.

How will my shares be voted if I do not specify how they should be voted?

If you sign and send your form of proxy but do not indicate how you want your shares to be voted, your shares may be voted by the person that you appoint as your proxy as he or she sees fit or such person may abstain in relation to any business of the Meeting.

Can I change my vote or revoke a proxy?

A registered shareholder can revoke his or her proxy before the time of voting at the Meeting by:

| • | emailing or mailing a revised form of proxy dated later than the prior form of proxy; or |

4

| • | notifying the Company’s registrar (Computershare) in writing that you are revoking your proxy. Your revocation must be received by Computershare not less than 48 hours (not including non-business days) before the time of the Meeting to be effective; or |

| • | voting in person at the Meeting. |

If your ordinary shares are held in an account at a brokerage firm, bank or similar organization, you may change or revoke your voting instructions by contacting the broker, bank or other nominee holding the shares.

Who counts the votes?

Computershare Investor Services PLC (“Computershare”) has been engaged as our independent agent to tabulate shareholder votes. If you are an ordinary shareholder of record, you can directly submit your proxy online to Computershare at www.investorcentre.co.uk/eproxy (see instructions on form of proxy) or you can return your executed form of proxy to Computershare for tabulation

If you hold your ordinary shares through a broker, your broker will directly submit your proxy to Computershare online or return the form of proxy to Computershare.

If you are a holder of record of ADSs, you can return your executed ADS proxy card to Citibank, N.A. for tabulation. If you hold your ADSs through a broker, bank or other organization, that organization can return the ADS proxy card to Citibank, N.A. following your instruction. Citibank, N.A. will submit your votes to Computershare for tabulation.

How are votes counted?

Votes will be counted by Computershare, who will separately count “for” and “against” votes, and “votes withheld” or abstentions. A “vote withheld” or abstention is not a vote in law and will not be counted in the calculation of the votes “for” and “against” a resolution.

How many votes do I have?

On a show of hands, each ordinary shareholder of record present in person, and each duly authorized representative present in person of a shareholder that is a corporation, has one vote. On a show of hands, each proxy present in person who has been duly appointed by one or more shareholders has one vote, but a proxy has one vote for and one vote against a resolution if, in certain circumstances, the proxy is instructed by more than one shareholder to vote in different ways on a resolution. On a poll, each shareholder present in person or by proxy or (being a corporation) by a duly authorized representative has one vote for each share held by the shareholder.

What if I plan to attend the Meeting?

Attendance at the Meeting will be limited to ordinary shareholders of record as of 6:30 p.m. London time (1:30 p.m. Eastern Standard Time) on Monday, May 23, 2022. In order to obtain admittance to the Meeting each shareholder may be asked to present valid picture identification, such as a driver’s license or passport. If your ordinary shares are held through brokerage accounts or by a bank or other nominee you may be able to attend at the discretion of the Chairman.

How do you solicit proxies?

We will solicit proxies and will bear the entire cost of this solicitation. The initial solicitation of proxies may be supplemented by additional mail communications and by telephone, fax, e-mail, internet and personal solicitation by our directors, officers or other employees. No additional compensation for soliciting proxies will be paid to our directors, officers or other employees for their proxy solicitation efforts. We also reimburse Citibank, N.A. for their expenses in sending materials, including ADS proxy cards, to ADS holders of record.

What do I do if I receive more than one notice or form of proxy?

If you hold your ordinary shares in more than one account, you will receive a form of proxy for each account. To ensure that all of your shares are voted, please sign, date and return all forms of proxy. Please be sure to vote all of your shares.

5

Will there be any other business conducted at the Meeting?

No. In accordance with our Articles of Association, no matters other than proposals 1 through 10 may be presented at this Meeting. We have not been notified of, and our Board is not aware of, any other matters to be presented for action at the Meeting.

What is the role of KPMG?

KPMG LLP (“KPMG”) is our auditor for the fiscal year ended December 31, 2021 and our Audit Committee has selected KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2022, and has further directed that we submit the selection of KPMG for approval by our shareholders at the Meeting. Proposal 4 seeks your approval of the re-appointment of KPMG to serve as our auditor, to hold office until the conclusion of the next annual general meeting of shareholders.

KPMG are entitled to attend any general meeting of the Company and be heard on any part of the business of the meeting that concerns them as auditors.

What is Computershare’s role?

Computershare is our registrar. All communications concerning ordinary shareholder of record accounts, including address changes, name changes, ordinary share transfer requirements and similar issues can be handled by contacting Computershare at tel: +44 (0) 370 702 0000 or by writing to Computershare Investor Services PLC, The Pavilions, Bridgwater Road, Bristol, BS99 6ZY, England.

Communications concerning ADS holder of record accounts can be handled by contacting Citibank, N.A. — ADR Shareholder Services at tel: +1-877-248-4237 (toll free within the United States) or +1-781-575-4555 (for international callers) or by email: citibank@shareholders-online.com or at Citibank Shareholder Services, P.O. Box 43077, Providence, RI 02940-3077.

How can I find out the results of the voting at the Meeting?

Voting results will be announced by the filing of a current report on Form 8-K within four business days after the Meeting. If final voting results are unavailable at that time, we will file an amended current report on Form 8-K within four business days of the day the final results are available.

Directions to Meeting

Directions to our Meeting, which is to be held at 60 Jubilee Avenue, Milton Park, Abingdon, Oxfordshire OX14 4RX, are available in the Contact section of our website at: https://www.adaptimmune.com

6

Our Board of Directors currently consists of nine directors.

Our Articles of Association require that those directors who were appointed by the Board since our 2021 Annual General Meeting must retire from office and may offer themselves for re-election. No directors have been appointed by the Board since our 2021 Annual General Meeting.

Additionally, our Articles of Association require one-third (or such number nearest to but not exceeding one-third) of our directors who are subject to retirement by rotation to retire from office at each annual general meeting, being those directors longest in office since their last re-election or appointment. In the case of equal tenure, retirement is by agreement. Of the nine directors subject to retirement by rotation, Dr. Ali Behbahani, Mr. John Furey and Mr. James Noble, will, on this occasion, retire from office and stand for re-election by our shareholders.

Having carried out an evaluation of the individual performance of each of Dr. Behbahani, Mr. Furey and Mr. Noble with the support of the Corporate Governance and Nominating Committee, the Board is satisfied that their performance continues to be effective and that they continue to demonstrate commitment to their roles. The Board considers that it is entirely appropriate for each of Dr. Behbahani, Mr. Furey and Mr. Noble to seek re-election at the AGM.

Each of the above directors has been nominated for re-election and no other nominees for directors have been presented. Therefore, it is anticipated that following the AGM, if all of the above directors are re-elected, the Board of Directors will be comprised of nine members.

In connection with proposals 1 through 3, we set forth the biographical information for the nominees to our Board of Directors. For biographical information for the other directors see Board of Directors and Corporate Governance.

7

PROPOSAL 1 — RE-ELECTION OF ALI BEHBAHANI TO THE BOARD OF DIRECTORS

Dr. Ali Behbahani is currently a member of our Board of Directors and has been nominated for re-election as a director. If elected, he will hold office from the date of his election until the next annual general meeting of shareholders where he must retire by rotation and offer himself for re-election, or until his earlier death, resignation or removal. Dr. Behbahani has agreed to serve if elected, and we have no reason to believe that he will be unable to serve.

Dr. Behbahani, 45, has served as a Non Executive Director since February 2015 and also serves as a member of our Corporate Governance and Nominating Committee. He formerly served as a Non-Executive Director of Adaptimmune Limited since September 2014, initially in a capacity as a nominee of NEA, one of our shareholders. Dr. Behbahani has been a General Partner on the healthcare team at NEA since 2018, having worked for the fund since 2007, specializing in investments in the biopharmaceutical and medical device sectors. He is currently a board member of public companies Arcellx (Nasdaq: ACLX), Black Diamond Therapeutics, Inc (Nasdaq: BDTX), CRISPR Therapeutics AG (Nasdaq: CRSP), CVRx (Nasdaq: CVRX), Genocea (Nasdaq: GNCA), Minerva Surgical (Nasdaq: UTRS), Monte Rosa Therapeutics (Nasdaq: GLUE), Nkarta (Nasdaq: NKTX) and Oyster Point Pharma, Inc (Nasdaq: OYST) and formerly served as a director of Nevro Corp (NYSE: NVRO). He also serves as a director for several private companies, including Arcellx, 858 Therapeutics, Cardionomic, Korro Bio, Spyglass Pharma, Stablix and Tune Therapeutics. He has previously worked as a consultant in business development at The Medicines Company and held positions as a Venture Associate at Morgan Stanley Venture Partners from 2000 to 2002 and as a Healthcare Investment Banking Analyst at Lehman Brothers from 1998 to 2000. Dr. Behbahani conducted basic science research in the fields of viral fusion inhibition and structural proteomics at the National Institutes of Health and at Duke University. He holds an M.D. degree from The University of Pennsylvania School of Medicine and an M.B.A. from The University of Pennsylvania Wharton School. Our Board of Directors believes Dr. Behbahani’s qualifications to serve as a member of our board include his financial expertise, his experience as a venture capital investor, his extensive experience in the healthcare industry and his years of experience in his leadership roles as a director and executive officer.

Based on his extensive experience as a senior executive and board member in the pharmaceutical and healthcare sectors, the Corporate Governance and Nominating Committee concluded that Dr. Behbahani is qualified to serve on our Board of Directors. Dr. Behbahani recused himself from the Corporate Governance and Nominating Committee’s deliberations concerning his nomination.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE RE-ELECTION OF ALI BEHBAHANI TO THE BOARD OF DIRECTORS

8

PROPOSAL 2—RE-ELECTION OF JOHN FUREY TO THE BOARD OF DIRECTORS

Mr. John Furey is currently a member of our Board of Directors and has been nominated for re-election as a director. If elected, he will hold office from the date of his election until the next annual general meeting of shareholders where he must retire by rotation and offer himself for re-election, or until his earlier death, resignation or removal. Mr. Furey has agreed to serve if elected, and we have no reason to believe that he will be unable to serve.

Mr. Furey, 57, has served as a Non-Executive Director since July 2018 and also serves as a member of our Audit Committee and of our Remuneration Committee. He has over 30 years of experience of developing and implementing operational strategies and leading commercial and technical teams. Mr. Furey has served as the Chief Executive Officer of Imvax, Inc since September 2019. He also serves as an independent board member of Sensorion (Euronext Growth: ALSEN). Prior to joining Imvax, Mr. Furey served as Chief Operating Officer at Spark Therapeutics, Inc from December 1, 2016 through December 31, 2018, where he was responsible for global commercial operations, medical affairs, technology development and technical operations. Prior to joining Spark Therapeutics, Mr. Furey was senior vice president and head of global operations for Baxalta, where he directed manufacturing, quality, engineering, and process development. He actively managed a $2.5 billion production budget across Baxalta’s global network and led a first-in-class supply chain organization for rare diseases. Mr. Furey led the team that coordinated and delivered the successful establishment of Baxalta through a spin out from Baxter and led the Baxter Vaccine inline business to realize significant top line and bottom line growth. He also spent two years in China as general manager of Pfizer’s vaccine business unit following a role with responsibility for global pricing and reimbursement at Pfizer Vaccines. In these roles, Mr. Furey gained extensive experience in pipeline development and global product launches. Earlier in his career, he held both commercial and operations positions of increasing scope and responsibility with Pfizer and Wyeth Pharmaceuticals. Mr. Furey has an executive M.B.A. from St. Joseph’s University, Philadelphia, a B.S. degree from Trinity College, Dublin, and a diploma in Environmental Health from the Technology University, Dublin. Our Board of Directors believes Mr. Furey’s qualifications to serve as a member of our board include his extensive experience in the biopharmaceutical industry and his years of experience in his leadership roles as an executive officer.

Based on his extensive experience as a senior executive in the pharmaceutical and healthcare sectors, the Corporate Governance and Nominating Committee concluded that Mr. Furey is qualified to serve on our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE RE-ELECTION OF JOHN FUREY TO THE BOARD OF DIRECTORS

9

PROPOSAL 3—RE ELECTION OF JAMES NOBLE TO THE BOARD OF DIRECTORS

Mr. James Noble is currently a member of our Board of Directors and has been nominated for re-election as a director. If elected, he will hold office from the date of his election until the next annual general meeting of shareholders where he must retire by rotation and offer himself for re-election, or until his earlier death, resignation or removal. Mr. Noble has agreed to serve if elected, and we have no reason to believe that he will be unable to serve.

Mr. Noble, 63, has served as a Non-Executive Director since September 2019. He formerly served as our full-time Chief Executive Officer since March 2014, and part-time CEO from July 2008 to March 2014, and is one of our co-founders. From July 2008 until March 2014, Mr. Noble was also CEO of Immunocore. Mr. Noble has over 30 years of experience in the biotech industry. He has held numerous non-executive director positions. Mr. Noble previously served as Deputy Chairman of GW Pharmaceuticals plc and as a director of CuraGen Corporation, PowderJect Pharmaceuticals plc, Oxford GlycoSciences plc, MediGene AG, and Advanced Medical Solutions plc. Mr. Noble currently serves as Chairman of Orexo AB and also serves as Chairman of Sutura Therapeutics and as a director of Celleron Therapeutics. Mr. Noble qualified as a chartered accountant with Price Waterhouse and spent seven years at the investment bank Kleinwort Benson Limited, where he became a director in 1990. He then joined British Biotech plc as Chief Financial Officer from 1990 to 1997. Mr. Noble was previously Chief Executive Officer of Avidex Limited, a privately held biotechnology company that was our predecessor, from 2000 to 2006. Mr. Noble holds an M.A. degree from the University of Oxford. Our Board of Directors believes Mr. Noble’s qualifications to serve as a member of our board include his financial expertise, his extensive experience in the biopharmaceutical industry and his years of experience in his leadership roles as a director and executive officer.

Based on his extensive experience as a senior executive and board member in the biotechnology, pharmaceutical and healthcare sectors, the Corporate Governance and Nominating Committee concluded that Mr. Noble is qualified to serve on our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE RE-ELECTION OF JAMES NOBLE TO THE BOARD OF DIRECTORS

10

PROPOSAL 4 — RE-APPOINTMENT OF KPMG LLP AS OUR AUDITORS, TO HOLD

OFFICE UNTIL THE CONCLUSION OF THE NEXT ANNUAL GENERAL

MEETING OF SHAREHOLDERS

Proposal 4 seeks your approval of the re-appointment of KPMG LLP to serve as our auditor, to hold office until the conclusion of the next annual general meeting of shareholders. In the event this proposal does not receive the affirmative vote of the holders of a majority of the shares entitled to vote and who are present in person or represented by proxy at the Meeting, the Board of Directors may appoint an auditor to fill the vacancy.

Background to Proposal 4

Our Audit Committee has selected KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2022, and has further directed that we submit the selection of KPMG for approval by our shareholders at the Meeting.

The Audit Committee approves KPMG’s and its affiliates audit and non-audit services in advance as required under Sarbanes-Oxley and SEC rules. Before the commencement of each fiscal year, the Audit Committee appoints the independent auditor to perform audit services that we expect to be performed for the fiscal year and appoints the auditor to perform audit-related, tax and other permitted non-audit services. In addition, our Audit Committee approves the terms of the engagement letter to be entered into by us with the independent auditor. The Audit Committee has also delegated to its chairman the authority, from time to time, to pre-approve audit-related and non-audit services not prohibited by law to be performed by our independent auditors and associated fees, provided that the chairman shall report any decisions to pre-approve such audit-related and non-audit services and fees to our full Audit Committee at its next regular meeting. Additional information concerning the Audit Committee and its activities can be found in the following sections of this proxy statement: “Board Committees” and “Report of the Audit Committee.”

KPMG commenced auditing our annual financial statements with the fiscal year 2010.

Fees for Independent Registered Public Accounting Firm — KPMG

The table below sets forth a summary of the fees billed to the Company by KPMG for professional services rendered for the fiscal years ended December 31, 2021 and December 31, 2020. All such audit and audit-related services were pre-approved by the Audit Committee, which concluded that the provision of such services by KPMG was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

| Fees | December 31, 2021 ($) | December 31, 2020 ($) | ||||||

| Audit Fees(1) | 1,218,000 | 1,016,000 | ||||||

| Audit-related Fees(2) | 91,000 | 220,000 | ||||||

| Tax Fees(3) | — | — | ||||||

| All Other Fees(4) | — | — | ||||||

| Total | 1,309,000 | 1,236,000 | ||||||

| (1) | Audit fees for 2021 and 2020 consisted of fees for the audits of the Company’s annual consolidated financial statements and the audit of the effectiveness of the Company’s internal control over financial reporting, and the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q. | |

| (2) | Audit-related fees for 2021 and 2020 consisted primarily of fees billed in connection with registration statements and offerings. Included in the 2021 fees are fees billed in connection with the issuance of comfort letters. Included in the 2020 fees are fees billed in connection with our S-3 filing and public offerings. | |

| (3) | Tax Fees consist of fees for professional services, including tax consulting and compliance. There were no such fees incurred in 2021 or 2020. | |

| (4) | All Other Fees incurred were $nil in 2021 and $nil in 2020. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE RE-APPOINTMENT OF KPMG LLP AS OUR AUDITORS, TO HOLD OFFICE UNTIL THE CONCLUSION OF THE NEXT ANNUAL GENERAL MEETING OF SHAREHOLDERS

11

PROPOSAL 5 — AUTHORIZATION FOR THE AUDIT COMMITTEE TO DETERMINE THE AUDITORS’ REMUNERATION FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022

Proposal 5 authorizes the Audit Committee to determine our auditors’ remuneration for the fiscal year ending December 31, 2022. Fees for KPMG, our independent registered public accounting firm and U.K. statutory auditors, in respect of the years ended December 31, 2021 and December 31, 2020, are set forth in Proposal 4 above.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE AUTHORIZATION OF OUR AUDIT COMMITTEE TO DETERMINE OUR AUDITORS’

REMUNERATION FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022

12

PROPOSAL 6 — RESOLUTION TO ADOPT THE COMPANY’S U.K. STATUTORY ANNUAL

ACCOUNTS AND REPORTS

At the Meeting, our Board of Directors will present our U.K. statutory annual accounts and reports for the period January 1, 2021 through December 31, 2021, which includes the audited portion of the directors’ annual report on remuneration. We will provide our shareholders with an opportunity to receive the U.K. statutory annual accounts and reports and to adopt them.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE RESOLUTION TO ADOPT THE COMPANY’S U.K. STATUTORY ANNUAL ACCOUNTS AND REPORTS

13

PROPOSAL 7 — ADVISORY (NON-BINDING) VOTE TO APPROVE THE COMPANY’S EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended, and Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) enable our shareholders to approve, on an advisory, non-binding basis, the compensation of our named executive officers as disclosed under the “Executive Compensation Discussion and Analysis” section, the 2021 Summary Compensation Table and the related compensation tables, notes, and narrative in this proxy statement.

This proposal, known as a “Say-on-Pay” proposal, gives our shareholders the opportunity to express their views on our named executive officers’ compensation as a whole. This vote is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of all of our named executive officers and the philosophy, policies and practices described in this proxy statement.

Our compensation programs are designed to support our business goals and promote our long-term profitable growth. Our equity plans are intended to align compensation with the long-term interests of our shareholders. We urge shareholders to read the “Executive Compensation Discussion and Analysis” section, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives. We also encourage you to review the 2021 Summary Compensation Table and other related compensation tables and narratives, which provide detailed information on the compensation of our named executive officers. The Board and the Remuneration Committee believe that the policies and procedures described and explained in the “Executive Compensation Discussion and Analysis” section are effective in achieving our goals.

The vote under this Proposal No. 7 is advisory, and therefore not binding on the Company, the Board or our Remuneration Committee. However, our Board of Directors and Remuneration Committee values the opinions of our shareholders and will review and consider the voting results when making future decisions regarding our executive compensation program. Currently, we expect to hold an advisory vote on the compensation paid to our named executive officers each year and expect that the next such vote will occur at our 2023 annual general meeting of shareholders.

Shareholders will be asked at the Meeting to approve the following resolution pursuant to this Proposal No. 7:

“RESOLVED, that the shareholders of the Company approve, on a non-binding, advisory basis, the compensation of the Company’s “named executive officers,” as disclosed in this proxy statement under the “Executive Compensation Discussion and Analysis” section, the compensation tables and the narrative disclosures that accompany the compensation tables.”

THE BOARD RECOMMENDS YOU VOTE

FOR THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

SET FORTH IN THIS PROXY STATEMENT

14

PROPOSAL 8 — APPROVAL OF OUR U.K. STATUTORY DIRECTORS’ ANNUAL REPORT ON REMUNERATION

Our U.K. statutory directors’ remuneration report is set forth as Annex A to this proxy statement. The directors’ remuneration report includes the annual report on remuneration. This document describes in detail our remuneration policies and procedures and explains how these policies and procedures help to achieve our compensation objectives with regard to our directors and the retention of high-quality directors. Our Board of Directors and the Remuneration Committee believe that the policies and procedures as articulated in the directors’ remuneration report are effective and that as a result of these policies and procedures we have and will continue to have high-quality directors. Our Board of Directors has approved and signed the report in accordance with English law.

At the Meeting, the shareholders will vote on the annual report on remuneration, excluding the directors’ remuneration policy. The directors’ remuneration policy remains unchanged and is scheduled to be proposed for approval at the AGM to be held in 2024, as required by the U.K. Companies Act 2006. This vote is advisory and non-binding. Although non-binding, our Board of Directors and Remuneration Committee will review and consider the voting results when making future decisions regarding our director remuneration program. Following the Meeting, and as required under English law, the directors’ annual report on remuneration will be delivered to the U.K. Registrar of Companies.

THE BOARD RECOMMENDS YOU VOTE

FOR THE APPROVAL OF OUR U.K. STATUTORY DIRECTORS’ ANNUAL REPORT ON

REMUNERATION SET FORTH AS ANNEX A

15

BACKGROUND TO PROPOSALS 9 AND 10

Pursuant to the U.K. Companies Act 2006, our Board of Directors may only allot and issue shares or grant rights over shares if authorized to do so by our shareholders. Additionally, the U.K. Companies Act 2006 requires that where the Company wishes to issue shares for cash, we must first offer those shares on the same terms to existing shareholders of the Company on a pro-rata basis (commonly referred to as a statutory pre-emption right) unless this statutory pre-emption right is dis-applied, or opted-out of, with the approval of the shareholders.

Our Board of Directors anticipates that there may be occasions when they need flexibility to finance business opportunities and growth, or otherwise act in the best interests of the Company, by the issuance of shares or grant of rights over shares without a pre-emptive offer to existing shareholders. To ensure our continued ability to respond to market conditions and address business needs, our Board of Directors considers it appropriate that they be authorized to allot shares up to an aggregate nominal amount of £310,638.00 and be empowered to allot shares or grant rights over shares pursuant to this authority on a non-pre-emptive basis. This authority to allot shares and power to allot shares on a non-pre-emptive basis would apply until the earlier of the conclusion of the annual general meeting in 2023 and June 30, 2023, and will replace all of the existing authorities and powers granted by our shareholders.

These proposals 9 and 10, our Share Authority Proposals, are, in the Board’s view, appropriate to avoid us potentially being at a competitive disadvantage as compared to our peer companies, many of whom are incorporated in the United States. In particular, the requirement to first offer shares that we propose to issue for cash to all of our existing shareholders in time-consuming pro-rata rights offerings would considerably reduce the speed at which we could complete capital-raising activities undertaken in furtherance of our growth strategy and would potentially make it difficult for us to complete such transactions. Many of our strategic competitors are incorporated in the United States where they are not subject to restrictions on their ability to issue shares.

The Share Authority Proposals are fully compliant with U.K. company law, consistent with U.S. capital markets practice and governance standards, and if approved, will keep us on an equal footing with our peer companies who are incorporated in the United States. Further, approval of the Share Authority Proposals by shareholders will not exempt the Company from any Nasdaq corporate governance or other requirements, including those limiting the issuance of shares. For these reasons, we, therefore, consider that the Share Authority Proposals are appropriate to the needs of the Company and in the interests of shareholders.

We are asking you to approve our Share Authority Proposals to allow us to continue to execute on our business and growth strategy in a timely and competitive manner.

The full details of the proposals are set forth below.

16

PROPOSAL 9 — AUTHORIZATION OF ALLOTMENT OF SHARES

Under the U.K. Companies Act 2006, our Board of Directors cannot allot shares in the Company (other than pursuant to an employee share scheme) unless they are authorized to do so by the Company in general meeting. The Directors currently have an existing authority to allot shares in the Company and to grant rights to subscribe for or convert securities into shares in the Company. This authority was granted to the Directors on May 14, 2021 and was in respect of a maximum aggregate nominal amount of £307,869.00, which represented approximately 33% of the then issued ordinary share capital of the Company. It remains unexercised in respect of approximately [ ] % of the Company’s issued ordinary share capital. Resolution 9 is an ordinary resolution to seek a new authority, which will replace the existing authority.

Resolution 9 proposes that the Directors are granted authority to allot new shares or to grant rights to subscribe for or to convert any security into shares in the Company up to a maximum aggregate nominal amount of £310,638.00. This amount represents approximately [ ]% of the issued share capital of the Company as of April 19, 2022. If approved by shareholders, this authority will expire on the earlier of the conclusion of the annual general meeting in 2023 and June 30, 2023.

The Directors have no present intention of exercising this authority, except in relation to the Company’s share incentive schemes, but believe it is in the interests of shareholders for the Directors to have this flexibility to allot shares otherwise than just in relation to the Company’s share incentive schemes should circumstances and their intentions change.

The grant of this authority will not exempt the Company from applicable Nasdaq requirements to obtain shareholder approval prior to certain share issuances or to comply with applicable SEC disclosure and other regulations. Our Board of Directors will continue to focus on and satisfy its fiduciary duties to our shareholders with respect to share issuances.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE APPROVAL OF PROPOSAL 9

17

PROPOSAL 10 — DISAPPLICATION OF PRE-EMPTION RIGHTS

As a UK incorporated company, the Company’s ordinary shareholders are entitled, under the U.K. Companies Act 2006, to pre-emption rights, whereby, in the event that the Company wishes to allot new equity securities for cash, those securities must first be offered to existing shareholders in proportion to the number of ordinary shares they each hold before they can be offered to new shareholders.

In practice, the operation of such pre-emption rights is onerous and can result in significant delay and additional expense to the cost of an equity fundraising. It is therefore customary for our Board of Directors to seek authority from our shareholders to dis-apply statutory pre-emption rights for cash issues of up to a limit approved by the Company’s shareholders.

With the Company solely listed on Nasdaq, and the Company’s peers, key shareholders and primary target market being in the United States, the Board is mindful of the fact that equivalent United States incorporated companies are not required to offer shares to existing shareholders on a pre-emptive basis in the event they are pursuing an equity fundraising. The Board considers that this may place the Company at a competitive disadvantage.

Therefore, Resolution 10 seeks a disapplication of pre-emption rights for cash issues of up to a certain proportion of the Company’s issued ordinary share capital. Our Board of Directors currently has a power to allot shares as if the rights of pre-emption applicable under the U.K. Companies Act 2006 did not apply for cash issues. This power was granted to the Directors pursuant to shareholder resolutions passed on May 14, 2021 and was in respect of a maximum aggregate nominal amount of £307,869.00 which represented approximately 33% of the then issued ordinary share capital of the Company. It remains unexercised in respect of approximately [ ]% of the Company’s issued ordinary share capital.

The Directors have decided to seek a new disapplication of pre-emption rights for cash issues to replace the existing power. This Resolution will, if passed, give the Directors power, pursuant to the authority to allot granted by Resolution 9, to allot shares for cash or to grant rights to subscribe for or to convert any security into shares without first offering them to existing shareholders in proportion to their existing holdings up to an aggregate maximum nominal amount of £310,638.00, which represents approximately [ ]% of the Company’s issued share capital as of April 19, 2022.

This Resolution will be required to be passed as a special resolution and, if passed, this power will expire on the earlier of the conclusion of the annual general meeting in 2023 and June 30, 2023.

The Directors have no present intention of exercising this power, except in relation to the Company’s share incentive schemes, but believe it is in the interests of shareholders for the Directors to have this flexibility to allot shares for cash otherwise than just in relation to the Company’s share incentive schemes should circumstances and their intentions change.

Our Board of Directors considers that, at this stage of development of the Company, the ability to raise new equity funds at relatively short notice and at low cost is vital to the continuing financial health of the business. We believe that it is in the best interests of the Company and our shareholders for the Board to seek to retain the ability to readily raise new equity funds at the appropriate time.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE APPROVAL OF PROPOSAL 10

18

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

BOARD OF DIRECTORS

Directors

Below is a list of our Directors and their ages as of the date of this proxy statement.

| Name | Age | Position | ||

| David M. Mott | 56 | Chairman of the Board of Directors | ||

| Lawrence M. Alleva | 72 | Non-Executive Director | ||

| Ali Behbahani, M.D. | 45 | Non-Executive Director | ||

| Barbara Duncan | 57 | Non-Executive Director | ||

| John Furey | 57 | Non-Executive Director | ||

| James Noble. | 63 | Non-Executive Director | ||

| Elliott Sigal, Ph.D, M.D. | 70 | Non-Executive Director | ||

| Tal Zaks, Ph.D, M.D. | 56 | Non-Executive Director | ||

| Adrian Rawcliffe | 50 | Chief Executive Officer and Director |

The table below provides certain information regarding the diversity of our Board of Directors as of the date of this proxy statement.

| Board Diversity Matrix | ||||

| Country of Principal Executive Offices: | England | |||

| Foreign Private Issuer | No | |||

| Disclosure Prohibited under Home Country Law | No | |||

| Total Number of Directors | 9 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Part I: Gender Identity | ||||

| Directors | 1 | 8 | 0 | 0 |

| Part II: Demographic Background | ||||

| Underrepresented Individual in Home Country Jurisdiction | 1 | |||

| LGBTQ+ | 0 | |||

| Did Not Disclose Demographic Background | 0 | |||

During the year ended December 31, 2021, there were four full meetings of the Board of Directors. All of our then Directors attended a minimum of 75% of the aggregate of the meetings of the Board of Directors and meetings of its committees of which he or she was a member during 2021.

The biographical information for Ali Behbahani, John Furey and James Noble, the nominees to our Board of Directors, is provided in “Proposal 1 — Re-Election of Ali Behbahani to the Board of Directors”, “Proposal 2 — Re-Election of John Furey to the Board of Directors” and “Proposal 3 — Re-Election of James Noble to the Board of Directors” respectively.

Below is biographical information for those directors who are not standing for re-election at this Meeting and who will remain seated following the Meeting.

David Mott has served as our Chairman since January 2017 and as a Non-Executive Director since February 2015. He also serves as Chairman of our Remuneration Committee and of our Corporate Governance and Nominating Committee. He formerly served as a Non-Executive Director of Adaptimmune Limited since September 2014, initially in a capacity as a nominee of New Enterprise Associates (“NEA”), one of our shareholders. Mr. Mott formerly served as a General Partner of NEA, an investment firm focused on venture capital and growth equity investments, from September 2008 to February 2020, and led its healthcare investing practice. Prior to joining NEA, he was President and Chief Executive Officer of MedImmune LLC, a subsidiary of AstraZeneca Plc, and Executive Vice President of AstraZeneca Plc. From 1992 to 2008, Mr. Mott worked at MedImmune and served in roles including Chief Operating Officer, Chief Financial Officer, President and Chief Executive Officer. Prior to joining MedImmune, Mr. Mott was a Vice President in the Health Care Investment Banking Group at Smith Barney, Harris Upham & Co., Inc.

19

Mr. Mott is currently a private investor through Mott Family Capital. He is Chairman of Ardelyx, Inc. (Nasdaq: ARDX), Epizyme, Inc. (Nasdaq: EPZM), Imara, Inc. (Nasdaq: IMRA) and Mersana Therapeutics, Inc., (Nasdaq: MRSN) and serves as a director of Novavax, Inc. (Nasdaq: NVAX). He previously served as Chairman of TESARO, Inc. (Nasdaq: TSRO) and as a director of Nightstar Therapeutics plc (Nasdaq: NITE). He has also previously served on numerous public and private company boards. Mr. Mott received a Bachelor of Arts degree in economics and government from Dartmouth College. Our Board of Directors believes Mr. Mott’s qualifications to serve as a member of our board include his financial expertise, his experience as a venture capital investor, his extensive experience in the pharmaceutical industry and his years of experience in his leadership roles as a director and executive officer.

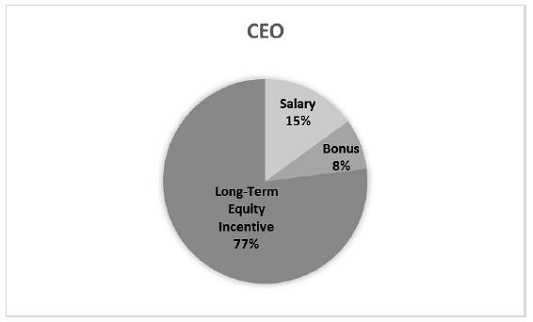

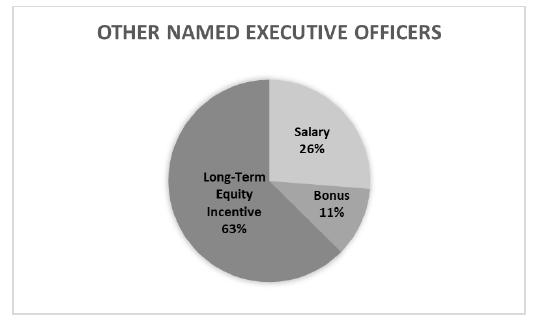

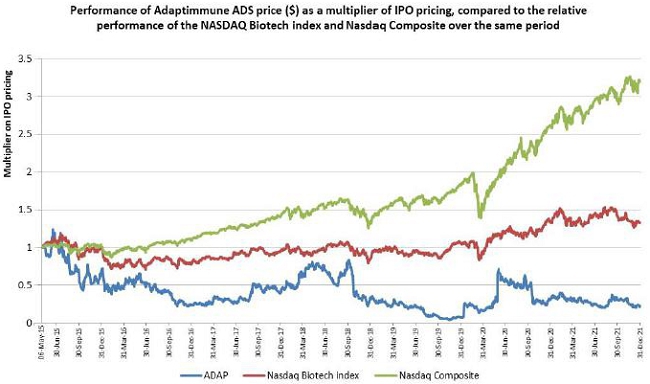

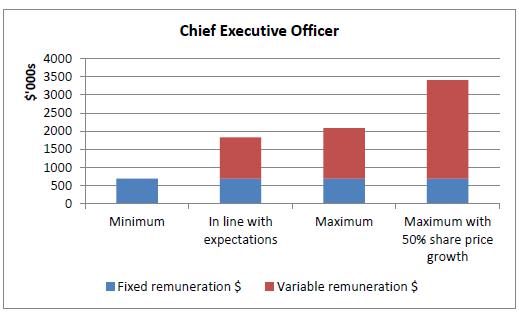

Lawrence Alleva has served as a Non-Executive Director since March 2015 and also serves as Chairman of our Audit Committee. He is a former partner with PricewaterhouseCoopers LLP (PwC), where he worked for 39 years from 1971 until his retirement in June 2010, including 28 years’ service as a partner. Mr. Alleva worked with numerous pharmaceutical and biotechnology companies as clients and, additionally, served PwC in a variety of office, regional and national practice leadership roles, most recently as the U.S. Ethics and Compliance Leader for the firm’s Assurance Practice from 2006 until 2010. Mr. Alleva currently serves as a director for public companies Bright Horizons Family Solutions, Inc. (NYSE: BFAM), Mersana Therapeutics, Inc. (Nasdaq: MRSN) and Galera Therapeutics, Inc (Nasdaq: GRTX) and chairs the audit committee for those companies. He previously served as a director of Mirna Therapeutics, Inc. (NYSE: MIRN) and TESARO, Inc. (Nasdaq: TSRO), and of GlobalLogic, Inc. through the sale of the company in 2013 and chaired the audit committee for those companies. Mr. Alleva is a Certified Public Accountant (inactive). He received a B.S. degree in Accounting from Ithaca College and attended Columbia University’s Executive M.B.A. non-degree program. Our Board of Directors believes Mr. Alleva’s qualifications to serve as a member of our board include his financial expertise, his extensive experience working with public companies on corporate finance and accounting matters as a Certified Public Accountant (inactive), his experience serving as a director on other corporate boards and his experience in a senior leadership role at PwC.