The Company expects to satisfy the POC Trial obligation over time over the period that the trial is completed, based on an estimate of the percentage of completion of the trial determined based on the costs incurred on the trial as a percentage of the total expected costs. The revenue allocated to the material right associated with the exclusive licence option will be recognized from the point that the option is either exercised and control of the license has passed to Galapagos or the option lapses.

The amount of the transaction price that is allocated to performance obligations that are unsatisfied or partially satisfied under the agreement as of September 30, 2024 was $99,836,000, of which $44,236,000 is allocated to the POC Trial performance obligation and $55,600,000 is allocated to the material right for the exclusive option.

The Genentech Collaboration and License Agreement

On April 12, 2024 the Company announced the termination of the Genentech Collaboration Agreement, entered into by Adaptimmune Limited, a wholly-owned subsidiary of the Company, in relation to the research, development and commercialization of cancer targeted allogeneic T-cell therapies which was originally scheduled to be effective from October 7, 2024. The termination was accounted for as a contract modification on a cumulative catch-up basis. The termination did not change the nature of the performance obligations identified but resulted in a reduction in the transaction price as the additional payments and variable consideration that would have been due in periods after October 7, 2024 will now never be received.

The Company originally expected to satisfy the performance obligations relating to the initial ‘off-the-shelf’ collaboration targets and the personalized therapies as development progressed and recognized revenue based on an estimate of the percentage of completion of the project determined based on the costs incurred on the project as a percentage of the total expected costs. The Company expected to satisfy the performance obligations relating to the material rights to designate additional ‘off-the-shelf’ collaboration targets from the point that the options would have been exercised and then as development progressed, in line with the initial ‘off-the-shelf’ collaboration targets, or at the point in time that the rights expired. The Company expected to satisfy the performance obligations relating to the material rights to extend the research term from the point that the options would have been exercised and then over the period of the extension, or at the point in time that the rights expired.

The aggregate remaining transaction price that had not yet been recognized as revenue as of the date of the termination was $146,301,000 which included the remaining deferred revenue that had not been recognized as revenue as of the date of the modification and the variable consideration to be billed under the collaboration until the effective date of the termination that is still considered probable. The termination resulted in a cumulative catch-up adjustment to revenue at the date of the termination of $101,348,000 and a further $20,741,000 of revenue recognized in the second quarter of 2024.

On September 23, 2024, the Adaptimmune Limited entered into a Mutual Release and Resolution Agreement (the “Mutual Release Agreement”) with Genentech. This agreement, among other things, resolved and released each party from any and all past, present and future disputes, claims, demands and causes of action, whether known or unknown, related to the Genentech Collaboration Agreement in any way. Under the terms of the Mutual Release Agreement, Genentech will pay the Company $12.5 million upon which the Genentech Collaboration Agreement will be terminated. The Agreement was effective immediately as of September 23, 2024.

The Mutual Release Agreement resulted in all remaining performance obligations being fully satisfied and the remaining deferred revenue of $25,298,000 and the additional payment of $12,500,000 were both recognized as total revenue of $37,798,000 in the third quarter of 2024.

The GSK Termination and Transfer Agreement

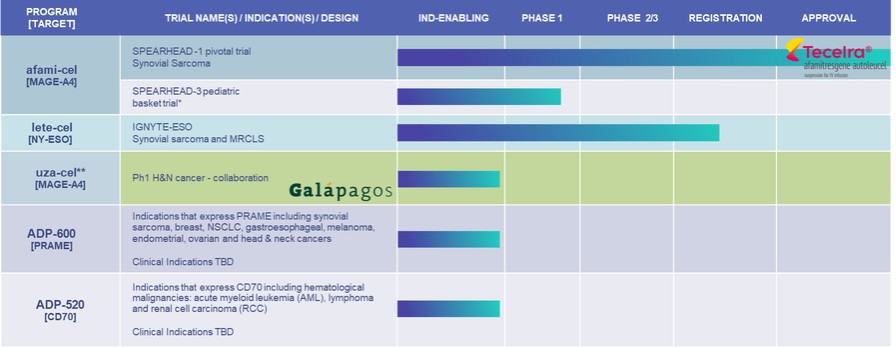

On April 6, 2023, the Company and GSK entered into the Termination and Transfer Agreement, regarding the return of rights and materials comprised within the PRAME and NY-ESO cell therapy programs. The parties will work collaboratively to ensure continuity for patients in ongoing lete-cel clinical trials forming part of the NY-ESO cell therapy program.

As part of the Termination and Transfer Agreement, sponsorship and responsibility for the ongoing IGNYTE and long-term follow-up (“LTFU”) trials relating to the NY-ESO cell therapy program will transfer to the Company. In return for this, the Company received an upfront payment of £7.5 million in June 2023, following the signing of the agreement, and milestone payments of £3 million, £12 million, £6 million and £1.5 million in September and December 2023 and June and August 2024, respectively. No further payments are due from GSK under the Termination and Transfer Agreement.